- From Hope to Disappointment –

The new government of Tamam Salam sent positive signals to the markets during the first part of the 2nd quarter of 2014.

However, this positivism was short lived, and recession resurged as the master of the game.

A wave of hope and optimism prevailed in the markets as soon as formation of a new government of national benefit was finally announced in mid-February, after 10 months of standstill, and following the implementation of a long expected security plan in the North and the Beka’a that brought back a relatively peaceful atmosphere on the grounds.

These positive signals have encouraged traders to re-stock, especially in the wake of the approaching Ramadan season and summer vacations that were both expected to be – logically, promising, be it at the level of local consumers spending, or at the level of the receding fears of Lebanese emigrants and Gulf nationals and their subsequent return to Lebanon after the levy of the travel ban from their respective governments, and the resulting revitalization of consumer spending in the various retail sectors.

Over and above, the encouraging perspectives pushed traders to invest money for the maintenance of their showrooms and delivery fleets, and even for the purpose of marketing and advertising campaigns.

As a result, and after almost 3 years of continuous decline, the economic activity has witnessed acceptable levels during the months of April and May of this year.

However, this positive situation was short-lived, as things turned upside down as a result of the vacancy of the seat of the president of the republic. The ensuing political and institutional chaos had a very negative impact on the economic situation, an impact that was further worsened by the persistent and obstinate stance of the coordination body of syndicates concerning the salary grid adjustments claims, not taking into consideration the dangerous consequences of such decision on the already fragile economic and financial situation in the country.

As a result of all the above, the consolidated figures for the second quarter of 2014 were once again more than disappointing, and pointed to the persistence of the alarming decline that has become intrinsically structural in the Lebanese retail trade scenery. The consolidated figures have posted, during the second quarter of 2014, a decline of

13.12 % in comparison to the second quarter of 2013.

|

Yearly Variation between Q2 – 2013 and Q2- 2014 |

|||

|

Q2 - 2014 |

Q2 - 2013 |

||

|

89.15 |

100.00 |

Nominal Year to Year Variation |

|

|

2.55% |

CAS Official Inflation Rate between June ’13 and June ’14 (as per the official CAS figures) |

||

|

-13.12% |

86.88 |

100.00 |

Real Year to Year Variation |

The main lingering negative factors that continued to undermine the markets and contribute to further deterioration of consumption during the second quarter of 2014, and that overweighed all the positive signals that had briefly encouraged the traders, were:

- Tensions resulting from the resumption of terrorist activities and explosions.

- Increased political conflicts that did not only prevent, but also complicated, the election of a new president of the republic.

- Tensions provoked by the escalade of the conflict related to the salary grid.

- Almost total absence of Gulf countries visitors and receding numbers of Lebanese expatriates visits to their home country during the period under study.

- Further decline in the purchasing power resulting from deterioration in the Lebanese households’ income.

As a result of all the above, activity in most retail sectors continued to display further slowdown during the second quarter of 2014 as compared to their levels of activity during the same quarter of 2013. The decrease in turnover varied between sectors, as detailed below:

- A sharp drop of 37.14% in the pharmaceuticals sector, after having experienced increase during the first quarter of this year.

- A decline that reached 29.41% in the retail sales of telecommunication equipment (i.e. mainly cellular phones).

- Also a sharp decline that reached 24.57% in the retail sales of bookstores and stationeries.

- 9.62% drop in the sales of household items.

- A 10.33% real decline in the sales of footwear and of 2.79% in the sales of clothes (despite continuing heavy discounts offered in these two sectors during the period under study).

- A real drop of 5.65% in the liquor and spirits sales.

- The continuing decline in the sales of supermarkets (0.75%), against a 5.89% increase in the sales of the bakery sector that reflects increased demand in this specific sector for the very basic food necessities only.

- Finally, a continuing slowdown in the activity of snacks and restaurants, that dropped by a further 1.38%.

- On the other hand, the volume of sales of petroleum displayed an increase of 3.61%.

Moreover, a comparison between the levels of activity of Q1 of 2014 and Q2 of 2014 shows that the aggregated level of activity of the retail trade sector has witnessed a quarterly decline of 6.12%.

Hence, the acceptable level of sales witnessed at the start of the second quarter as indicated earlier, was overweighed by the sharp drop experienced thereafter following the total change in the current situation of the country.

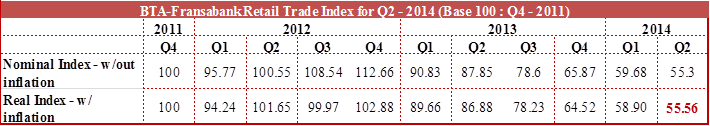

As a result, with our base index 100 fixed at the fourth quarter of 2011, and with a quarterly inflation rate of -0.48% for the second quarter of 2014, as per the official CAS report,

We hereby announce that the “BTA-Fransabank Retail Index” is:

55.56 for the second quarter of the year 2014.

In conclusion, the positive signals resulting from the formation of the government of Mr. Tamam Salam did translate concretely in the markets during the early days of the second quarter of this year, but the total change of the situation on the ground soon after appears to have hit sharply these retail markets again and overweighed all the positive results that had started to be witnessed.

It has thus become clear that from now on isolated positive signals are not anymore sufficient to help revive the retail markets. What is obviously needed is a drastic change in structural factors, a drastic change that can only emanate from a sound institutional life, and from addressing the security situation in the country with utmost efficiency within coherent and coordinated state institutions, a fact that will result in building up again the confidence of Lebanese expats and gulf visitors, and restoring a sound – long awaited, economic and social life in the country, that will in turn bring back trust and confidence amongst consumers and investors, and hence bring back a healthy level of activity to the markets.

Categories

- Log in to post comments